Become a US brand.

Launch your ambition as a US Startup

For Foreign businesses, a company set-up with a solid foundation

is the first step to expanding business in the US

Key to solid foundation

Right structure with right ownership

EntryUSA's focus is your business growth

Higher Sales & Expansion

Straight to the Point

Company Formation Landscape

Whether you are a small or a public enterprise from a foreign country,

company formation in the US is about what you want to accomplish

Whether you are a small or a public enterprise from a foreign country, company formation in the US is about what you want to accomplish

The BIG Picture for Foreign Entities

- B2B selling of products

- B2C selling: eComm selling (Amazon, etc) or retail shops

- Software development, BPO/KPO, manpower supply.

- Raise funds (Angel, VC)

- Manufacture for Made-in-US Stamp

- Company acquisition for expansion

- Get L1A to expand your business.

- Export products from the US to other countries like India.

- Invest in real estate

2 Options:

- Limited Liability Company (LLC)

- C-Corporation

To select which structure is most suitable for you, consider:

- Flexibility in operations

- Tax obligations

- Transferability of ownership interests

- Size of your foreign business

- Business continuity

- In which state/s* do you have nexus?

- Nexus: your US partner, office, warehouse, employees, or clients in case of B2B.

- Do you want to protect your identity?

*you may have to register in multiple states in case you've employees, offices, and warehouses in those states.

Calling New Jersey your Business Home (#)- Entry USA’s team is NJ-based

- 8,000 sq. ft. office building - business center

- Newark Airport - 35 mins from our office; Direct flights to Delhi & Mumbai.

- Port of NY NJ: 35 mins from our office and warehouse

- 38 million consumers live within a 3-hour of drive from NJ State

- $2.8 Trillion in GDP within a 3-hour drive from NJ State

- 5 Foreign trade zones

- You can own the US company as an Individual and/or as a subsidiary of your Indian company.

- Ownership Percentage*

- Will your US company be a subsidiary (51% or more owned by your Indian company)?

- Will the owners (individuals) in the US company be the same with the same percentage?

- Who will be the signing Authority in the US company?

- Maybe your new US company will hold your Indian company?

* If Yes (to 1 and 2), you are eligible for L1A Visa.

1700+ Companies | In all the 50 US States

Forming a Company with EntryUSA

We Listen

US Company Formation

50 States - 1 to 7 days

EIN - Federal Tax ID

- 4* weeks for foreign entities

- 1 day with SSN

We Reflect

Registered Agent

- $0 for life* in NJ

- $0 for 1 year in 49 States

Business Mailing Address

Virtual - $0 for 1st year in NJ

We Fulfill

Business Governing Document Template

- Operating Agreement (LLC)

- Bylaws (C-Corp)

Allotment of Shares

Common Stock Certificate to the founders

We Listen

We Reflect

We Fulfill

Getting Started - Talk to Us to get to US

Fill out the form >> We will call to understand your Business Plan >> Raise the invoice >> Start your company formation

Running your Company

Banking

Overseas Direct Investment (ODI)

to fund your US bank account from a foreign country, like India

Business Insurance

to protect you & your business from lawsuits, accidents, and natural disasters

Bookkeeping & Accounting:

to keep systematic financial record

Tax filing & Reporting

to remain compliant with US tax laws

Banking

Overseas Direct Investment

Banking

Protect you & your business from lawsuits, accidents, and natural disasters

Book keeping & Accounting

Keep systematic financial record

Tax filing & Reporting

Remain compliant with US tax laws

From anywhere in the world to anywhere in the US

Trusted by all, from entrepreneurs to large companies

Calling New Jersey Your Business-home

Home Advantage

- New Jersey is our Home-State

- We'll become your registered agent at no cost*

- Our address will become your virtual address

- we'll provide our office space to you,

- You will never miss on your compliance because we are there

- Our whole team is NJ based

*we file your annual taxes OR you rent an office space with us

Strategic Advantage

- 8,000 sq. ft. office building - business center

- List Newark Airport - 35 mins from our office; Direct flights to Delhi and Mumbai.

- Port NY NJ: 35 mins from our office

- Access to 46.3 million consumers within a 4-hour drive

- Within 500 miles are states comprising over 29% of the U.S. population, 30% of U.S. businesses, 31% of U.S. jobs, and 32% of the U.S. GDP

EntryUSA's 1-Key solution makes it easy to do business in the US

EntryUSA's 1-Key solution makes it easy to do business in the US

Your company in the US means

more trust, revenue & brand value

FAQs

- Local Company

- Builds trust and increases organization visibility

- Buyers in the US are comfortable dealing with a domestic, American company

- Access to US banking. Profits generated can be invested further

- Selling globally in the USD

- Pricing & Payments

- Charge premium, in dollars, for your products or services

- Firm price

- No impact of currency fluctuation on the pricing: no involvement of foreign exchange as payment can be made in US dollars

- Hassle-Free Custom Cleared Products

- Buyers prefer a “Landed Duty Paid” product because they do not have to get involved with customs clearance.

- In-Time Delivery for Buyers

- Easy 3PL warehousing

- In case you warehouse your products in the US, they are made available within 3 days of releasing a Purchase Order

- Not dependent on international transit times and availability of containers, vessels, and shipping schedules

- Get an L1A visa to come to the US to work for your own company and get a Green Card

- Easy raising US venture capital

- Pay ZERO tax on exported products/services

- Pay ZERO tax on sales within the USA. (Subject to founder not being a US citizen, green-card holder or resident / and transactions not being ETOB or FDAP)

- Will you be doing an ODI of more than $250,000 which means you can't open it as an Individual?

- Your goals in the US,

- The size of revenue you project that your company will make in the US

- You want to raise angel or VC funding.

- Selling Products

- B2B: No sales tax is to be collected so no filing is required

- B2C: Sales tax to be collected and filed with the State

- Selling Services

- B2B: No in most States

- B2C: No in most States

It is hard to say which one is better. C-Corp is taxed as a separate entity. LLC, on the other hand, is not taxed as a separate entity and that means that the income from LLC will pass through to the owners. For small businesses, LLC is preferred.

C Corp is a more formal, standardized, and stiff structure than an LLC. Both reporting and record-keeping requirements are more strict in C-Corp than in LLC. C-Corp is often the preferred incorporation choice for developing a business since owners are not responsible for business debts and liabilities. It is preferred by startups interested in raising venture funds for their business.

If you form an LLC, you have fewer state-imposed obligations. LLC is a simpler structure to manage which means that LLC offers greater flexibility in running the business. Taxwise, LLCs have more options than corporations. Meeting notes are not required by law.

If you form an LLC then you, as a beneficiary or owner, may have to report your global income in the US whereas in a C Corp you report the income that you have under this corporation, and you're not exposed to report everything else that you have in your country of residence like India.

It is not the ‘best’ state but the ‘most suitable’ state that you shall look at for opening your company. Every state offers different benefits and have different tax formalities. The way you should decide the State for your company formation is where you will have 'nexus' - meaning where you have company relationships (for example - your partner), company office, warehouse, or employees.

Let us say, for example, you open up a company in Delaware but you end up renting a space in a warehouse in NJ or hiring an employee in NJ or having an office in NJ. All these three items - warehouse, employee and office - makes New Jersey your nexus and with you will end up filing taxes in New Jersey along with Delaware.

So it will be simpler, easier and more streamlined to register your business in the state where you will be doing the business.

Note: In specific scenario like your company wants to raise money in the US or you want to take your company public in the US or your holding foreign company is a listed company, then Delaware state can be a suitable choice for registering your company in.

In a scenario where you do not want your US clients to know that you have opened your company in the US or you do not want your competitors to find out if you own a company in the US, then you can register your company in the States which offers anonymity.

It all depends if the SSN is active or not. As long as the SSN is active, you can open your company using it as we don't need to know where you stay as of now, although you need to provide a valid US Address.

You can call the SSN administration to find out if the SSN is Active or not.

Not necessarily, but there could be additional taxes in this scenario. For example, if you make $100 in net profit then we'll try to divide how much of this amount was from NJ and how much was NC based. Now, let us say that NJ has no activity except that you have the business registered in NJ and all of $100 was made in NC then you'll pay the taxes in NC and also the minimum tax in NJ i.e. $500.

If you make $50 from NJ and $50 from NC, then you'll pay the computed tax in both states. Now, if the computed tax is less than the minimum tax value (of the State), then also you'll pay the minimum tax value. So there is not necessarily double taxation between the states but some additional taxes depending on how much profit you made from each State.

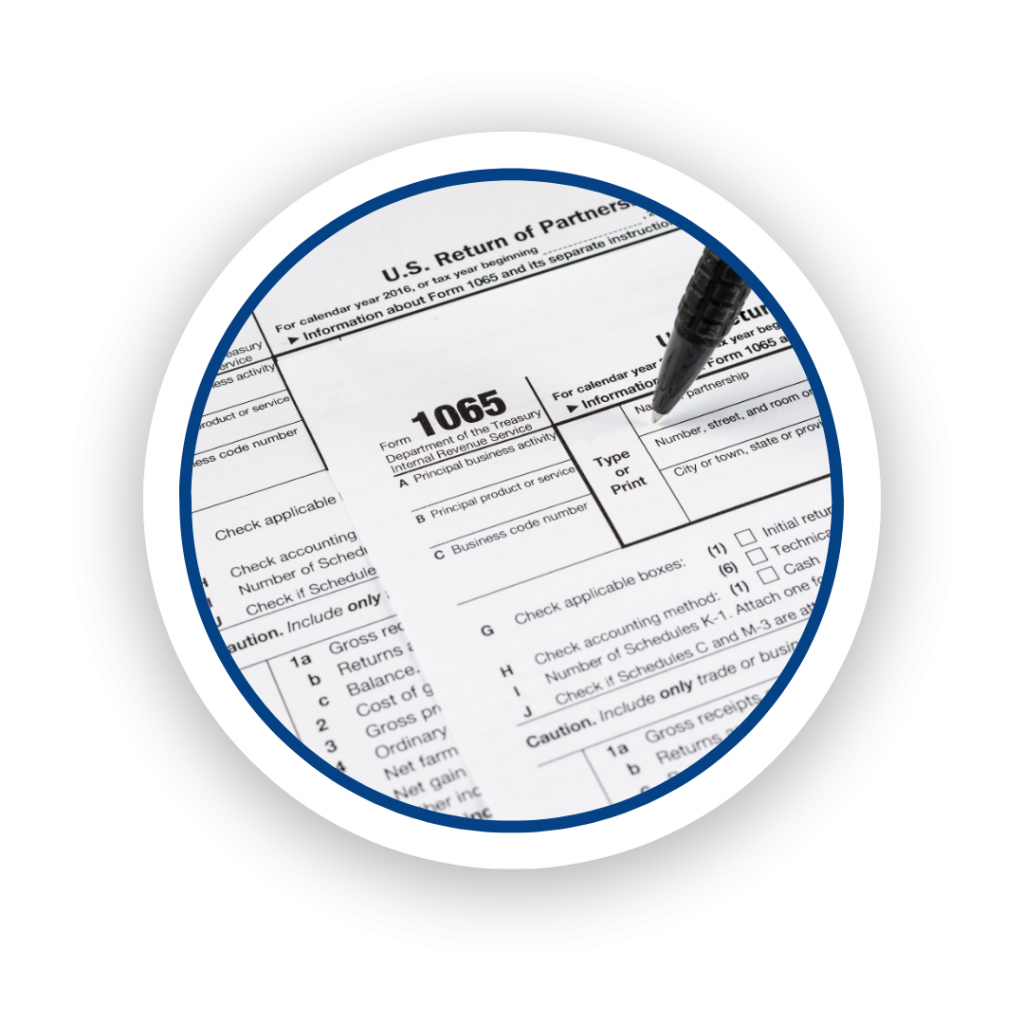

For filing a company’s tax returns in the US, it is not necessary you have to follow the calendar year. It means that if you open your company in November 2022 with only 1 month left before the year-end, then it is not necessary to file your business tax returns in March or April 2023.

Business tax filing is in fact done 3.5 months after the end of the 1st year of your company formation. This means that if you open the company on 30th November 2022, then your company’s tax returns will be due on March 15th, 2024. This applies to only a) C-Corp and b) Single member LLC filing as C-Corp or S-Corp.

For a) Single-member LLC (which has to go with personal tax returns) and b) an LLC filing as a partnership, you have to follow the calendar year for their tax returns.

You must inform the CPA about what year-end date you want to choose for your business at the time of company formation.

So, based on your business needs, you are free to select the year-end of your business.

If you have the money in your company's bank account in the US then you have the right to invest the money however you choose to as long as there is a direct benefit to your business.

Now, if you have the money in your personal bank account and not the business bank account then you can invest the money in real estate, stocks, etc.

Anyone who has any sort of Visa in the US, who is legally here in the country is considered as a resident of this country. Residency is not defined by the Visa type, but it is defined by being in this country for more than 183 days. People who file 1040 and return as 1040 are allowed to be registered agents for any business.

So, to summarize anyone who is on an H1B Visa can be the registered agent, and people who are saying I used to be on an H1B Visa or I used to have an F1 Visa and are now in India cannot be considered as a Registered agent. So, to be a Registered Agent you have to have a valid US address, there is no requirement for an SSN for a Registered Agent, the requirement is to be a resident of this country and to have a valid US Address.